The Power of Vanguard: How This Financial Giant Shapes the World

Discover how Vanguard, a global financial powerhouse, wields influence across markets and industries, redefining investments and reshaping global economies.

Did you know there’s a financial powerhouse quietly influencing nearly every aspect of the global economy? You may not see its name plastered across headlines daily, but its impact is undeniable.

Meet Vanguard, the investment management giant with trillions of dollars in assets under management.

Whether you’re a seasoned investor or someone who’s barely glanced at a 401(k) statement, Vanguard has likely shaped the financial tools you use and the industries you rely on.

But how did it rise to such dominance?

And what does its influence mean for the rest of us?

In this article, we’ll pull back the curtain on Vanguard’s massive reach, diving into its history, strategies, and the unique structure that has made it a global force. By the end, you’ll see why Vanguard isn’t just a company—it’s a financial ecosystem with the power to shape markets, industries, and perhaps even your future.

If you haven’t read our post on BlackRock, definitely check that out.

Who is BlackRock? A Deep Dive into the World’s Largest Asset Manager

BlackRock is the world’s largest asset management firm, overseeing trillions of dollars in assets for clients ranging from governments to institutions and individual investors. With a presence in over 100 countries, it has positioned itself as a critical player in global finance.

The Birth of a Giant

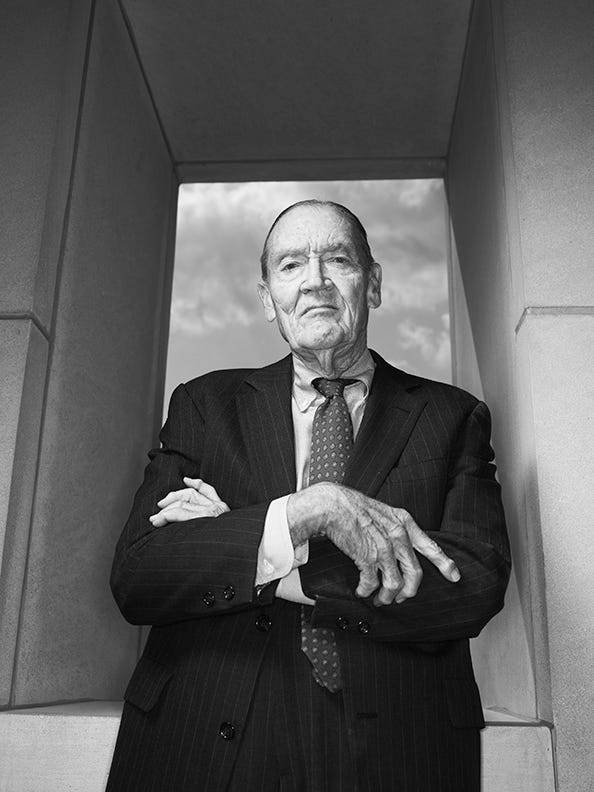

Every giant has humble beginnings, and Vanguard is no exception. It all started in 1975 with John C. Bogle, a visionary who dared to challenge the norms of Wall Street. At a time when investing was reserved for the wealthy and riddled with high fees,

Bogle had a radical idea: why not create a fund that simply tracks the market instead of trying to beat it?

This idea gave birth to the first-ever index fund, a product designed to mirror the performance of the market as a whole rather than relying on high-stakes (and often high-cost) stock picking. Critics mocked it as “Bogle’s Folly,” but the concept resonated with everyday investors. It was simple, transparent, and, most importantly, affordable.

From the beginning, Vanguard set itself apart with its unique structure. Unlike traditional investment firms, Vanguard operates as a mutual company owned by its fund investors.

This means its clients aren’t just customers—they’re stakeholders. By cutting out outside shareholders, Vanguard could focus solely on lowering costs and maximizing returns for its investors.

In essence, Vanguard democratized investing.

The seeds Bogle planted in the 1970s ballooned into a movement that would redefine the financial industry forever. Today it is the largest provider of mutual funds and the second-largest provider of ETFs. (BlackRock is first)

As of May 2024, Vanguard’s reach was, in a word, dominant.

$9.3 trillion in global assets

The largest shareholder in approximately two-thirds of U.S. companies

Holds stakes of 15% or more in 20+ firms from the S&P 500

So what does this reach look like?

The Scope of Vanguard’s Influence

Looking at dollars and stocks doesn’t do just to the sheer reach and influence that Vanguard has.

Ian Carroll, a thorough researcher and founder of “Cancel This Clothing Company”, did some incredible research on this:

Through his research, he uncovered that Vanguard is the top shareholder in 98% of the 100 biggest companies in America.

NINETY. EIGHT. PERCENT.

That is a nearly unimaginable amount of influence. Below is a list of some of these companies it is a top shareholder in, arranged from the highest to the lowest percentage of total shares controlled by Vanguard:

CBRE Group: Vanguard owns nearly 17% of this real estate firm, making it the largest shareholder.

Extra Space Storage: Vanguard holds approximately 16.7% of this real estate company, positioning it as the top investor.

PepsiCo: Vanguard is the largest shareholder with a 9.35% stake in the company.

Visa Inc.: Vanguard holds 8.94% of Visa's shares, making it the largest institutional investor.

The Coca-Cola Company: Vanguard owns 8.6% of Coca-Cola's shares, ranking as the second-largest shareholder after Berkshire Hathaway.

Alphabet Inc.: Vanguard holds a 7.25% stake in Alphabet, Google's parent company, making it the largest institutional shareholder.

The Hidden Hand: How Vanguard’s Massive Stakes Give Them Voting Power in Corporate Governance

Imagine a puppeteer pulling the strings behind the scenes—not controlling outright, but subtly guiding the show.

That’s a perfect way to describe Vanguard’s influence in corporate governance.

With massive stakes in thousands of companies, Vanguard doesn’t rely on direct ownership to make an impact. Instead, it flexes its power through voting rights on critical decisions like board elections, executive pay, and even social policies.

Here’s the twist: Vanguard holds these shares on behalf of its investors through mutual funds and ETFs, but it keeps the voting power.

That’s where the magic happens.

Being the top shareholder in many Fortune 500 companies, sometimes owning 7-10% of their shares, gives Vanguard a serious voice in shaping corporate policies. While that percentage might not sound huge, in the world of shareholder voting, it’s game-changing.

Unlike activist investors who make headlines with public demands, Vanguard (along with Black Rock and State Street) prefers private conversations with company leaders, pushing for long-term value behind closed doors.

Needless to say, this kind of influence in the hands of a few institutional players is risky. This “hidden hand” wields power that can shape industries, economies, and, even countries.

Global Influence and Market Power

Vanguard’s reach extends far beyond U.S. borders, making it a global financial powerhouse. Its investments span continents, influencing markets in Europe, Asia, and beyond. By managing assets across virtually every sector and region, Vanguard plays a key role in shaping the international financial landscape.

One clear example of Vanguard’s influence is its role in reshaping global markets. By popularizing low-cost index funds, Vanguard has made investing accessible to millions who were previously excluded.

In Europe, it has introduced competitive pricing and transparency standards that challenge traditional investment models.

In Asia, Vanguard’s growing presence has contributed to the rise of index-based investing, changing how individual and institutional investors approach wealth-building.

Decisions made at Vanguard headquarters have a ripple effect, influencing where capital flows and how industries evolve globally.

Then there’s the collective power of the “Big Three”: Vanguard, BlackRock, and State Street.

Together, these investment giants manage over $20 trillion in assets, holding significant stakes in almost every major publicly traded company. This dominance gives them unmatched voting power in corporate governance, allowing them to shape policies on everything from climate initiatives to executive pay.

What Vanguard’s Power Means for You

PROS:

Vanguard has made low-cost, high-value investment options the norm.

Its index funds and ETFs are among the most affordable in the market, allowing everyday investors to grow their wealth without losing a chunk of it to fees.

Vanguard’s focus on low costs and simplicity puts financial growth within reach for nearly everyone.

CONS:

The concentration of power in companies like Vanguard raises concerns about market influence.

With a handful of firms owning significant stakes in thousands of companies, decisions made by these giants can ripple through markets, sometimes prioritizing corporate interests over individual investors.

This can create a system where the voices of smaller investors would be overshadowed by the priorities of large institutional players (like vanguards and the others).

The Future of Vanguard

Vanguard is likely to continue its focus on low-cost investing, but with global markets facing increased volatility, its strategies may shift to adapt. As “sustainability and ethical” investing gain traction, Vanguard could place greater emphasis on ESG (Environmental, Social, and Governance) funds.

But why would a profit-driven company with trillions under management suddenly champion sustainability and social justice?

ESG initiatives aren’t about saving the planet—they’re about steering capital to companies that align with certain global agendas. By dictating what qualifies as "ethical" or "sustainable," Vanguard would exert control over which industries thrive and which ones collapse, shaping not just markets, but societal norms.

Then there’s technology and AI—tools that could further centralize power under Vanguard’s umbrella. Imagine an AI system capable of monitoring global markets, predicting trends, and reallocating trillions of dollars with surgical precision. Sounds sci-fi, but it’s already here, through Vanguard’s partner, BlackRock. You can read more about Blackrock’s ‘Aladdin’ Software here:

Who is BlackRock? A Deep Dive into the World’s Largest Asset Manager

BlackRock is the world’s largest asset management firm, overseeing trillions of dollars in assets for clients ranging from governments to institutions and individual investors. With a presence in over 100 countries, it has positioned itself as a critical player in global finance.

But what about Vanguard’s size? Could it really be an Achilles’ heel, or does it give the company an untouchable status? Regulatory scrutiny may seem like a threat, but with its influence over governments and economies, Vanguard is likely too big to fail.

Any setbacks would be superficial—controlled and designed to give the illusion of accountability.

Vanguard’s future isn’t about adapting to the financial landscape—it’s about shaping it to maintain power. Whether through ESG, AI, or sheer market dominance, the company’s moves could align less with profit maximization and more with consolidating control, leaving the rest of us as pawns in a global financial chess game.